Basic EPS does not factor in the dilutive effect of shares that could be issued by the company. Since basic EPS relates to earnings available only to common shareholders, the current year’s preferred dividends reduce from net income. Increasing basic EPS, however, does not mean the company is generating greater earnings on a gross basis. Companies can repurchase shares, decreasing their share count as a result and spread net income less preferred dividends over fewer common shares. Basic EPS could increase even if absolute earnings decrease with a falling common share count. Our earning per share calculator demonstrates how to determine EPS by starting with net income, adjusting for any preferred dividends, and then dividing by the average outstanding common shares.

What Is the Formula for Calculating Earnings per Share (EPS)?

One of the ways to make an informed investment decision is to compare the EPS figures for one company over a long time period. You can also compare EPS values for a few companies within the same industry to choose the most profitable one. All which corresponds to the owners (capital invested and retained earnings) is called equity. Consequently, a way to measure the return of the business compared to the investment of the owners is by using the return on equity calculator. Ideally, if EPS grows, ROE grows, but be careful; it does not always happen. When analysts or investors use earnings per share to make decisions, they are usually looking at either basic or diluted earnings per share.

Do you already work with a financial advisor?

$3 per share in EPS would be impressive if the company earned only $1 per share the year before. Considering the design of the EPS Calculator at iCalculator, you must have the three key values to start using it and know your company’s profitability, these are. The above chart shows that Starbucks ‘ basic EPS has increased substantially over the past 5 years.

- Ideally, if EPS grows, ROE grows, but be careful; it does not always happen.

- Holders of cumulative preferred shares are entitled to be paid current and past dividends (dividends in arrears) that the common shareholders have not paid.

- EPS growth refers to the positive change between earnings per share values reported by the company.

- To calculate a company’s earnings per share, take a company’s net income and subtract from that preferred dividend.

What are some of the different types of earnings per share?

It is important to note that generated revenue per share can be determined for different periods of time by taking into service the earnings per share calculator. Let us examine an example that describes the purpose of a tool in a better way. Since EPS is just one possible metric to use to examine companies’ financial prospects, it’s essential to use it in conjunction with other performance measures before making any investment decisions. The forward EPS is calculated using projections for some period of time in the future (usually the coming four quarters). As mentioned before, a good EPS growth rate is over 15%, and it will usually be preceded by a higher revenue growth rate.

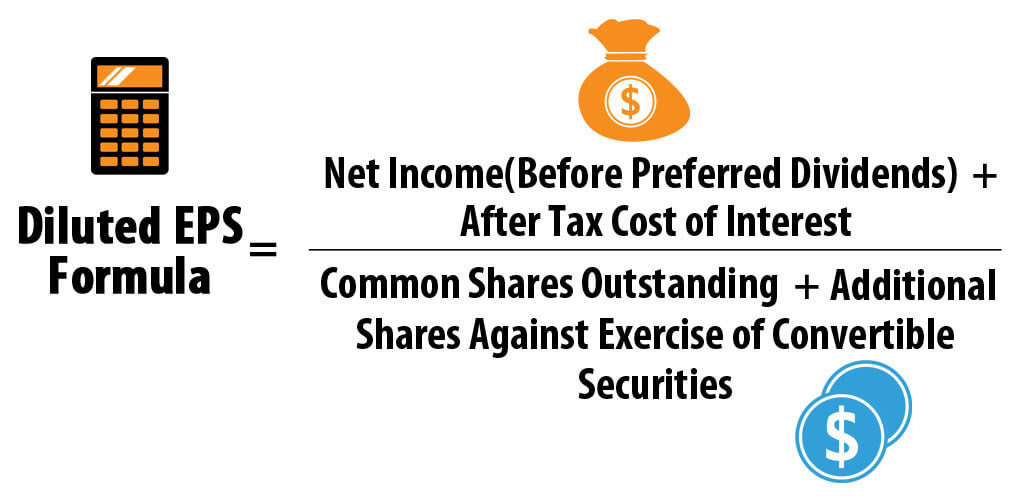

Diluted Earnings Per Share Formula

Most P/E ratios are calculated using the trailing EPS because it represents what actually happened, and not what might be. On the other hand, while the figure is accurate, the trailing EPS is often considered old news. In fact, a trailing EPS is calculated using the previous four quarters of earnings. Of course, as long as our earnings per share growth calculator gives a positive EPS growth %; we can say the earnings per share are increasing.

Earnings per Share (EPS) Calculator

The exercise of those options would add 1 million shares to the basic count. In theory, however, ABC could acquire 500,000 shares with the $10 million in proceeds. Companies generally report both basic earnings per share and diluted earnings per share. That is the company’s profit after all expenses, including operating expense, interest paid on borrowings, and taxes. Yes, it can talk about how much net profit a company has been earning, whether a company is generating higher yields, and whether one company is doing better than another in terms of earnings per share. But you should know that EPS alone cannot depict a great deal about a company’s financial health.

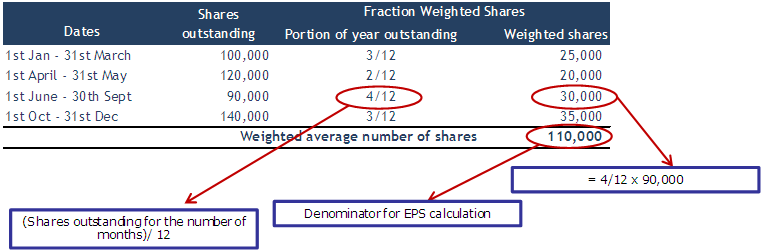

To calculate earnings per share, take a company’s net income and subtract preferred dividends. Then divide that amount by the average number of outstanding common shares. For such organizations, simply calculating earnings per share based on common shares what is the energy tax credit for 2020, 2021 how to claim and qualify alone may not be sufficient, as there are various sorts of shares, including convertible preferred stocks. Earnings per share (EPS) is a measure of a company’s profitability that indicates how much profit each outstanding share of common stock has earned.

While looking at a company and its EPS, you should look separately at the net profit and the outstanding equity shares. Choose the stock you want to analyze from the search bar (which will populate based on the ticker) or enter the financial data to explore from past years or quarters. For example, Tesla’s most recent report announced $12.556 billion in net income. The treasury stock method (TSM) requires the market share price, which we’ll assume is $40.00 as of the latest market closing date. Therefore, the potentially dilutive securities are assumed to be exercised, irrespective of whether they are “in-the-money” or “out-of-the-money”.

But, you need to know that the additional shares that can become outstanding will also be included as common stock. This can be for a number of reasons, including being part of the compensation plans of the company or as convertible debt/common stock. EPS, or earnings per share, is a financial figure studied by investors, traders, and analysts. It is used to draw conclusions about a company’s earnings stability over time, its financial strength, and its potential performance.

Italiano

Italiano

Leave a Reply